Operating ratios

The trend shows whether the company’s operational efficiency is improving or deteriorating. Investors compare the efficiency and profitability of companies in the same industry by analyzing their operating ratios, with lower ratios indicating greater operational efficiency and stronger profit potential. However, the operating expenses were not reduced relatively to the same extent as revenue growth, implying that cost control needs to be tightened further to consistently enhance profitability. From an investor perspective, the declining trend in the operating Ratio still provides a positive signal about ongoing operational efficiency initiatives. The operating ratio is only useful for seeing if the core business is able to generate a profit. Since several potentially significant expenses are not included, it is not a good indicator of the overall performance of a business, and so can be misleading when used without any other performance metrics.

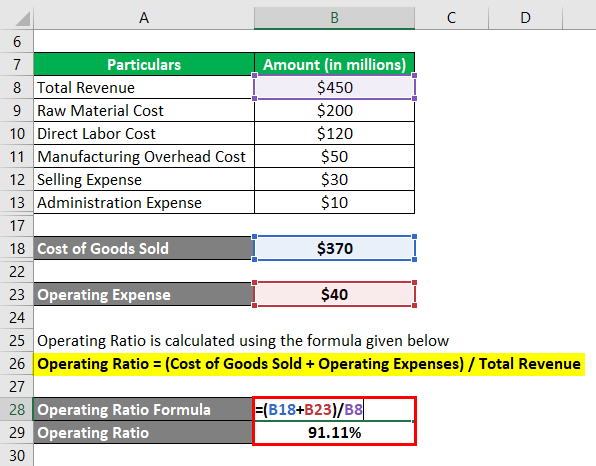

- The formula for calculating Operational Ratio is discussed in the following lines.

- Highly variable operating margins are a prime indicator of business risk.

- Assess management’s commentary on drivers of the operating Ratio and initiatives to improve it over time.

- First is a stable business model and cost structure that does not necessitate major adjustments.

Sample Financial Statements

A low ratio in comparison to that of competitors indicates that management is doing a good job of keeping costs in line. The operating ratio indicates little when taken as a single measure for one time period, since operating expenses can vary considerably between months. If sales are seasonal, it can make sense to compare a month’s results to those of the same month in the preceding year. Direct costs, often the most substantial portion of operating expenses, are directly tied to the production of goods or services. For a manufacturing company, this might include the cost of raw materials and wages for production staff. In contrast, a service-oriented business might focus more on labor costs and service delivery expenses.

Operating Expenses to Sales Ratio

When a company’s operating margin exceeds the average for its industry, it is said to have a competitive advantage, meaning it is more successful than other companies that have similar operations. While the average margin for different industries varies widely, businesses can gain a competitive advantage in general by increasing sales or reducing expenses—or both. Expressed as a percentage, the operating margin shows how much earnings from operations is generated from every $1 in sales after accounting for the direct costs involved in earning those revenues. Larger margins mean that more of every dollar in sales is kept as profit.

How Is Operating Margin Different From Other Profit Margin Measures?

A number that is this low may indicate that the company’s credit policies are too relaxed, or that the firm lacks credit efficiency. Operational leverage tends to fluctuate more widely within cyclical industries. Evaluate exposure to input costs and the ability to adjust the cost structure flexibly during downturns.

For more finance tips

This reflects positively on management’s ability to run the business efficiently and usually leads to a higher stock valuation. On the other hand, a high or increasing annual recurring revenue arr formula calculator suggests inefficient operations and excessive spending, which raises concerns over the company’s profitability. The term operating ratio refers to the efficiency of a company’s management by comparing the total operating expense (OPEX) of a company to net sales. The operating ratio shows how efficient a company’s management is at keeping costs low while generating revenue or sales.

How do operating income and revenue differ?

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

The goal is to understand the business dynamics driving the Ratio and gain confidence that current trends are sustained. Operating ratios are commonly used as a screening factor when searching for stock prospects. An investor might screen for stocks with operating ratios below 1.0 or that have improved by a certain percentage in the past year. The goal is to surface companies with metrics suggesting upside potential. Maintaining a lower operating ratio is a good way to achieve operational efficiency.

Some use simple measures in their numerators and denominators, such as COGS (Cost of Goods Sold) and revenue, but many incorporate other ratios into the calculation. Therefore, it is crucial to have a firm grasp on the most basic ratios, such as working capital. Like all ratios, these are only meaningful when compared across time, and to the industry norm.

These metrics, pivotal in strategic planning and performance evaluation, help stakeholders understand how well a company utilizes its resources to generate income. A company may need to implement cost controls for margin improvement if its operating ratio increases over time. An operating ratio that is decreasing is viewed as a positive sign, as it indicates that operating expenses are becoming an increasingly smaller percentage of net sales. A higher operating ratio is always harmful because a small margin is left for interest, income tax, dividends, and reserves.