What Is Closing Entries In Accounting

From this trial balance, as we learned in the prior section, you make your financial statements. After the financial statements are finalized and you are 100 percent sure that all the adjustments are posted and everything is in balance, you create and post the closing entries. The closing entries are the last journal entries that get posted to the ledger. Closing entries are put into action on the last day of an accounting period. There are various journals for example cash journal, sales journal, purchase journal etc., which allow users to record transactions and find out what caused changes in the existing balances. Closing entries are mainly used to determine the financial position of a company at the end of a specific accounting period.

Should closing entries be performed before or after adjusting entries?

All the temporary accounts, including revenue, expense, and dividends, have been reset to zero. The balances from these temporary accounts have been transferred to the permanent account, retained earnings. After closing both income and revenue accounts, the income summary account is also closed. All generated revenue of a period is transferred to retained earnings so that it is stored there for business use whenever needed. At the end of an accounting period when the books of accounts are at finalization stage, some special journal entries are required to be passed. In accounting terms, these journal entries are termed as closing entries.

Closing Entries FAQs

Afterwards, withdrawal or dividend accounts are also closed to the capital account. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry. Take note that closing entries are prepared only for temporary accounts. After the closing journal entry, the balance on the drawings account is zero, and the capital account has been reduced by 1,300.

How confident are you in your long term financial plan?

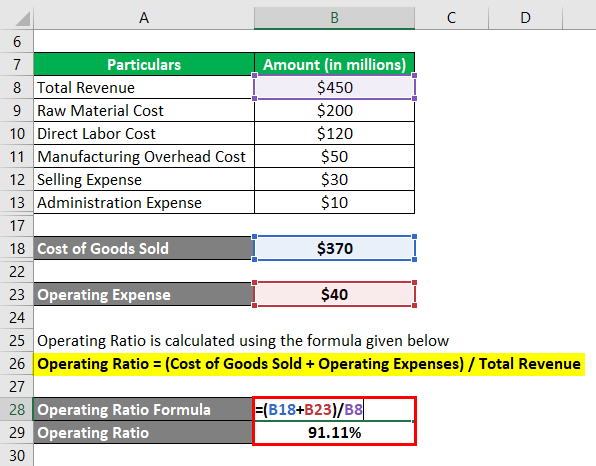

- Printing Plus has $140 of interest revenue and $10,100 of service revenue, each with a credit balance on the adjusted trial balance.

- Discover how this important step in finance ensures accurate financial statements.

- A closing entry is provided for the closing of income-expenditure accounts.

- Now that the temporary accounts have been closed, the next step is to transfer the balance from the income summary account to the retained earnings account.

With that, we also debit the income summary account to balance out the journal entry. Examples of temporary accounts are the revenue, expense, and dividends paid accounts. Any account listed in the balance sheet (except for dividends paid) is a permanent account.

How do you close revenue accounts?

Instead, as a form of distribution of a firm’s accumulated earnings, dividends are treated as a distribution of equity of the business. Net income is the portion of gross income that’s left over after all expenses have been met. The term can also https://www.simple-accounting.org/ mean whatever they receive in their paycheck after taxes have been withheld. Retained earnings are defined as a portion of a business’s profits that isn’t paid out to shareholders but is rather reserved to meet ongoing expenses of operation.

Do you already work with a financial advisor?

That’s why most business owners avoid the struggle by investing in cloud accounting software instead. An example would be if the company were to get sued, then a lawyer would be hired, and that fee would need to be paid. Preparing for Closing Entry is simple and quick, as all the required information can be easily found. Closing Entries are designed after Financial Statements for the fiscal periods are created, which means all the needed information is already there; you need to find it. The following example of closing entries will assist you in quickly comprehending closing entries. When preparing closing entries, there are a few things to bear in mind.

Step 1: Close Revenue accounts

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

You should recall from your previous material that retained earnings are the earnings retained by the company over time—not cash flow but earnings. Now that we have closed the temporary startup balance sheet accounts, let’s review what the post-closing ledger (T-accounts) looks like for Printing Plus. The first entry requires revenue accounts close to the Income Summary account.

Remember that all revenue, sales, income, and gain accounts are closed in this entry. Adjusting entries are used to modify accounts so that they’re in compliance with the accrual concept of recording income and expenses. From the Deskera “Financial Year Closing” tab, you can easily choose the duration of your accounting closing period and the type of permanent account you’ll be closing your books to.

All expense accounts will be zero, and the expenses account will be closed, by crediting the expenses account and debiting the income summary account. Closing entries is entries made to close and clear the revenue and expense accounts and to transfer the amount of the net income or loss to a capital account or accounts or to the retained earning accounts. Closing journal entries are part of the full accounting cycle and is the second to last step.

At the end of the year, all the temporary accounts must be closed or reset, so the beginning of the following year will have a clean balance to start with. In other words, revenue, expense, and withdrawal accounts always have a zero balance at the start of the year because they are always closed at the end of the previous year. Failing to make a closing entry, or avoiding the closing process altogether, can cause a misreporting of the current period’s retained earnings. It can also create errors and financial mistakes in both the current and upcoming financial reports, of the next accounting period. After the posting of this closing entry, the income summary now has a credit balance of $14,750 ($70,400 credit posted minus the $55,650 debit posted).

To get a zero balance in a revenue account, the entry will show a debit to revenues and a credit to Income Summary. Printing Plus has $140 of interest revenue and $10,100 of service revenue, each with a credit balance on the adjusted trial balance. The closing entry will debit both interest revenue and service revenue, and credit Income Summary.

This is no different from what will happen to a company at the end of an accounting period. A company will see its revenue and expense accounts set back to zero, but its assets and liabilities will maintain a balance. In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts. The last closing entry reduces the amount retained by the amount paid out to investors. If your revenues are greater than your expenses, you will debit your income summary account and credit your retained earnings account. Clear the balance of the expense accounts by debiting income summary and crediting the corresponding expenses.

They provide a framework for resetting temporary accounts, updating permanent accounts, and maintaining accurate records of financial performance. By understanding the importance of closing entries and avoiding common mistakes, companies can ensure the integrity of their financial records and instill confidence in stakeholders. The process of closing entries effectively resets the temporary accounts to zero, allowing the company to start fresh in the new accounting period. This ensures that the financial statements accurately reflect the company’s financial performance for the specific period and provides a clean slate to track the transactions of the upcoming period. On the other hand, the balances of the expense accounts are transferred to the income summary account or directly offset against the retained earnings account.

Closing all temporary accounts to the income summary account leaves an audit trail for accountants to follow. The total of the income summary account after the all temporary accounts have been close should be equal to the net income for the period. Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts. Income summary effectively collects NI for the period and distributes the amount to be retained into retained earnings. Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process.