Retired Shares Definition, Example, Methods, Journal

If the treasury stock is sold for more than cost, then the paid-in capital treasury stock is the account that is increased, not retained earnings. In auditing financial statements, it is a common practice to check for this error to detect possible attempts to “cook the books”. When a company decides to retire shares, it generally does so by issuing a notice of retirement to the shareholders.

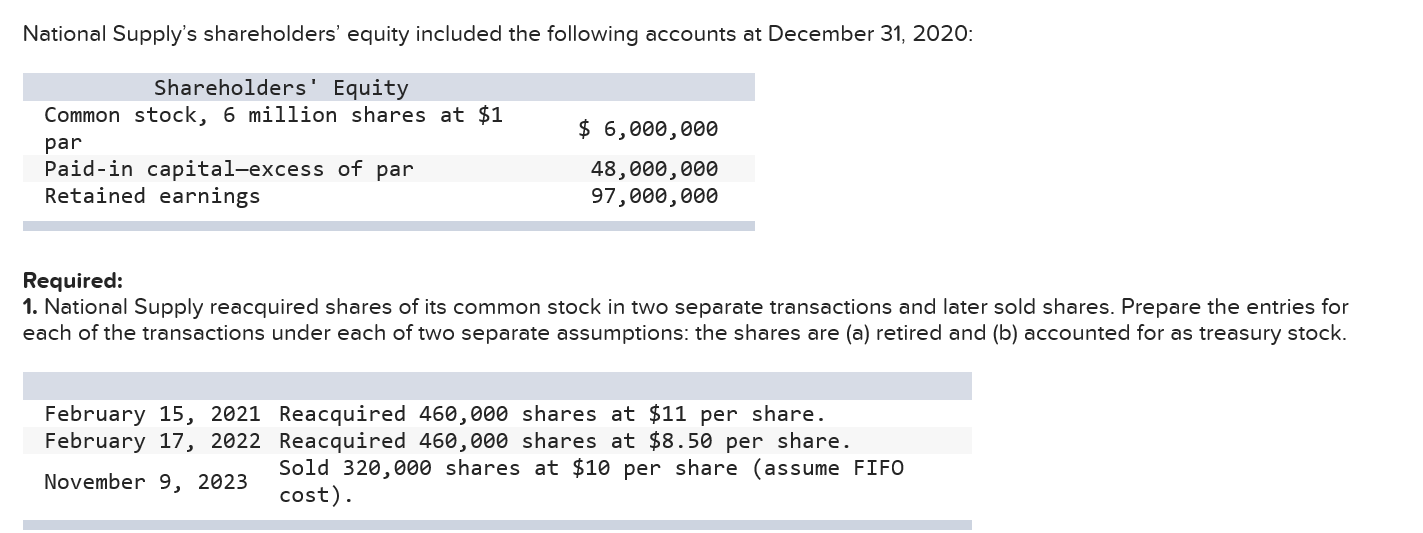

What includes in the journal entry of acquisition and retirement?

This is referred to as “shares outstanding,” or the total shares that exist for a company. Of those outstanding shares, some shares are restricted (meaning they cannot be traded unless certain conditions are met) while most shares are publicly traded (known as the “float”). Beyond making investors happy, corporations may have other motives for consolidating ownership. For example, with skilled executives in high demand, a company may offer stock options as a way to sweeten their compensation package. By accumulating treasury stock, they have the means to make good on these contracts down the road.

Which of these is most important for your financial advisor to have?

However, the retirement of shares was purely a fictional element designed to add suspense and increase interest among investors. Investors may get nervous if a company holds many authorized and unsold shares, as it gives a greater potential indication of share dilution in the future. Buying back shares can improve key financial metrics, particularly EPS, which is calculated by dividing net earnings by the number of outstanding shares. A lower number of outstanding shares can significantly boost EPS, making the company appear more profitable, even if overall earnings remain constant. When a company performs a share buyback, it can do several things with those newly repurchased securities.

Cost Method Stock Repurchase

The cost method of accounting values treasury stock according to the price the company paid to repurchase the shares, as opposed to the par value. Using this method, the cost of the treasury stock is listed in the stockholders’ equity portion of the balance sheet. Treasury stock refers to previously outstanding stock that was bought back from stockholders by the issuing company. The result is that the total number of outstanding shares on the open market decreases. Treasury stock remains issued but is not included in the distribution of dividends or the calculation of earnings per share (EPS).

In a Dutch auction, the company specifies a range, and the number of shares it wishes to repurchase. Shareholders are invited to offer their shares for sale at their personally desired price, within or below this range. The company will then purchase their desired number of shares for the lowest cost possible, by purchasing from shareholders who have offered at the lower end of the range. Treasury stocks are shares that were originally part of “shares outstanding” but that have been repurchased by the company.

The Inflation Reduction Act was passed in August 2022, which stipulates that public domestic companies must pay a 1% excise tax on stock buybacks starting after Dec. 31, 2022. Second, securities laws restrict the amount of purchases which transactions affect retained earnings and sales by the board due to the potential for manipulation, as well as their access to insider information not available to the public. Below is a break down of subject weightings in the FMVA® financial analyst program.

- Treasury Stock is credited for the total cost of the shares sold, and the account Additional Paid-in Capital from the Sale of Treasury Stock Above Cost is credited for the difference.

- The value attributable to each share has increased on paper, but the root cause is the decreased number of total shares, as opposed to “real” value creation for shareholders.

- The agency problem between the company and its employees can be solved simultaneously.

- If it is allowed, the journal entry depends on the method used to account for the acquisition of the shares.

Let’s assume, Berkshire Hathaway, a publicly traded company in the US, has 1,000,000 outstanding shares. The current market price of each share is $10, making the company’s total market capitalization $10,000,000. Repurchased shares either sit in the treasury (called treasury shares) or are retired (retired shares). Shares that sit in the treasury can be reissued at a future date, while retired shares cannot. For investors, understanding how and why companies use treasury stock can provide deeper insights into a company’s overall financial health and growth strategy. It signals confidence from management and can protect the company against hostile takeovers, giving shareholders a clearer picture of its long-term potential.

Or, enough stock in the company’s treasury can ensure nobody else will amass a controlling stake. When a company acquires some of its own shares, either through share buybacks or when the shares are initially created but not entirely sold to the public, there are two categories these shares can fall into — treasury shares and retired shares. On the other hand, if the cost of buying treasury stock is less than the amount that the company received when it was issued, the company needs to credit the difference into the paid-in capital from the retirement of stock instead.

When a company decides to repurchase treasury stock, it often requires a significant cash outlay. This expenditure can impact the company’s liquidity, particularly in the short term, as cash flow may become tighter. Therefore, companies usually conduct a careful cash flow assessment before deciding on a buyback to ensure that core operations won’t be affected and that unexpected funding needs can be met. These shares can benefit existing shareholders by increasing their ownership stake in the company and improving financial metrics like earnings per share. It may also positively impact the stock price due to the reduced number of shares available in the market.